6 Proven Tips for Creative Professionals to Get Paid Faster

Getting paid faster by your clients is of utmost importance to creative professionals because cash flow is king. Here are 6 tips to help expedite you getting paid.

Ron Dawson

Content Marketer

Last week I covered how professional creatives and small businesses can adopt proven strategies for consistently raising their rates. But it doesn’t matter how much you “technically” are paid if you go for long stretches of time with no checks coming in. That’s because, as the old adage goes...

Cash flow is king

As any small business person knows, cash flow is the life-blood of your business. It doesn’t matter if you have thousands or even tens of thousands of dollars owed to you if you’re not collecting. This is a bane to the small business artist because most artists hate having to play the accounts payable police. It can be awkward and intimidating having to call up a client asking “Where’s the check?”

But the truth is, you have to get paid. You did the work. You deserve it. You don’t have to feel guilty or awkward about asking what’s owed you. With that said, there are some etiquette tips for invoicing and requesting payment that are worth noting. Here are some things I’ve either learned on my own and/or gleaned from others in my over twenty years in business.

Establish the right contact

Make sure you have the right contact with your client for requesting invoices and payments. If you’re working with a larger company, it may be an individual from their accounting department. Especially if the main contact at your client is a creative director or product manager type, get the A/P contact. Busy creatives don’t have paying bills at the top of their priority list. Establish up-front who may be the best person to contact to follow-up on invoices, etc.

Know their system

Some companies (especially large ones) have very specific processes for paying their vendors. Venture one micron off that system and you may not get paid for months. These include, but aren’t necessarily limited to: having a purchase order (PO) and/or job number on your invoice; having an invoice number to give them; if your fee is broken into multiple payments, you may need a specific invoice for each payment; and submitting your invoice in time to make the company’s check run (many organizations cut checks on a specific day each week, so if you miss their cut off, you have to wait.) Also find out if they have certain invoice amounts that require a higher level of management to approve or sign (this is huge as submitting that full invoice for $10,000 vs. four invoices of $2,500 each could mean the difference of getting paid in two weeks vs. eight weeks.)

Set expectations

Make it clear up front what your payment terms are so you can go into the relationship with expectations correct. The best way to do this is to have it in your contract. (I’m assuming you have one. But then again, when it comes to creatives, I wouldn’t be surprised if some of you don’t. That may have to be a blog post for another day.)

Make it easy

Make it easy for your clients to pay you. Some clients may be able to pay with a credit card. Give them that option. You can use PayPal to accept all major credit cards (no PayPal membership is needed to make payments with a credit card using PayPal). If you don’t want to eat the credit card transaction fee (usually around 3%), pass the fee on. For payments of $500 or more, I would charge a 3% transaction fee when invoices are paid via credit card. They always have the option to pay via check to avoid the fee. At least 50% of the time, clients just pay the transaction fee.

Other forms of payment that don’t require a fee are Zelle and Bill.com. Technically, I believe Bill.com may have a monthly fee for companies that use it to pay their vendors and employees. But if they’re already using it, see if you can get on their system. Payment is quick and goes directly into your account. Stripe is another form of payment architecture that is common and worth looking into that charges similar transaction fees.

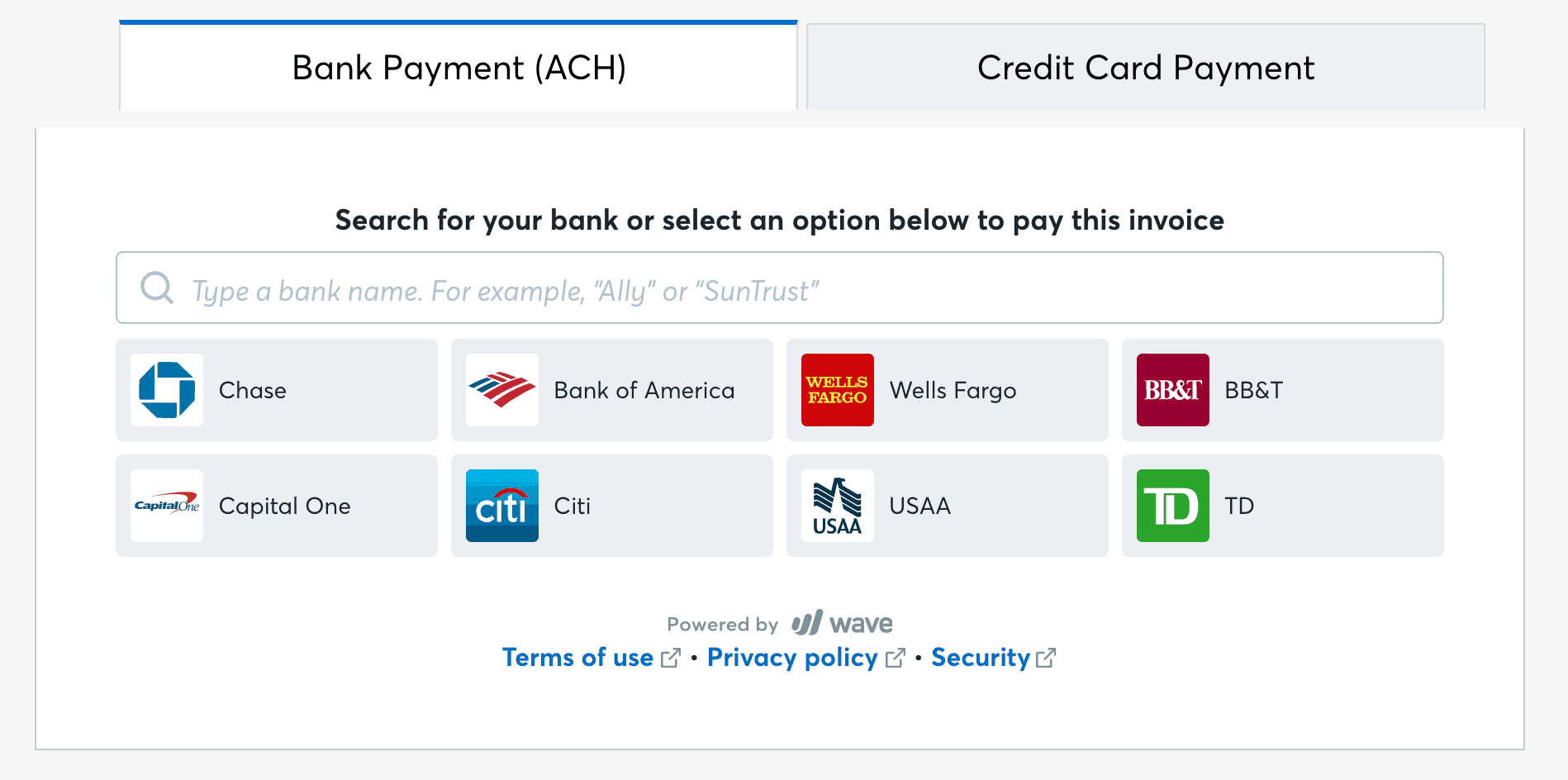

Many invoice services have incorporated payment gateways into their system, making it easier for you to collect payments right from the invoice. I use Wave Bookkeeping, and it allows for both credit and debit card transactions, as well as ACH direct deposits.

Follow up

Have a process to follow-up on invoices owed you. Maybe you send an email or two first. Then follow-up with a phone call. But do follow-up. Sometimes companies will purposefully sit on a check until you ask for it. They’re managing cash flow just like you. So, if you’re not asking, they may say, “Great. They obviously don’t need it right now. I’ll pay this other guy who keeps calling.” The squeaky wheel gets the oil. Many invoice systems have auto-reminders that go out if an invoice isn’t paid. Turn those reminders on!

Consider using a VA or bookkeeper

I know many of you are small businesses where you wear most, if not all of the hats. Consider hiring a virtual assistant or bookkeeper to help you collect funds. It alleviates you having to personally make those awkward calls or emails, and it also makes you come off more professional when you have a “department” that handles accounts receivable. Needless to say, using such an individual also frees up your time, and “time is money.”

Don’t be a jerk

It should go without saying that in the process of asking for and collecting payment, be polite and courteous. Accounts payable employees are often stressed and overworked. Especially if they’re working for a large organization. It’s quite often an accounting department handling dozens of tasks, putting out fires, and trying to make sure their employers are running smoothly. Even if you implement all of these strategies, it may take longer than you’d like. Remember there’s a human being on the other side of that email or phone call. They’re dealing with life, COVID, bosses, other vendors, and everything else, just like you. Make the accounting department people your friend. The little things in life, like ending an email with “I appreciate you,” can go a long way.

Do you have any tips you’ve learned over the years for getting paid on time?

***

[Header image by Yagnik Sankhedawala on Unsplash]

Read more

Join our Newsletter

Sign up to our newsletter for all things marketing.